Powered by CFRA’s ETF database, FUNDynamix provides ETF and fund focused product and investment specialists critical, timely insights to improve investment decision making and manage risk.

FUNDynamix

A dynamic data platform designed for ETF and fund professionals

Turnkey, web-based access to our global ETF data and statistics

Screen, visualize, monitor, and analyze data and trends across the ETF universe in real-time

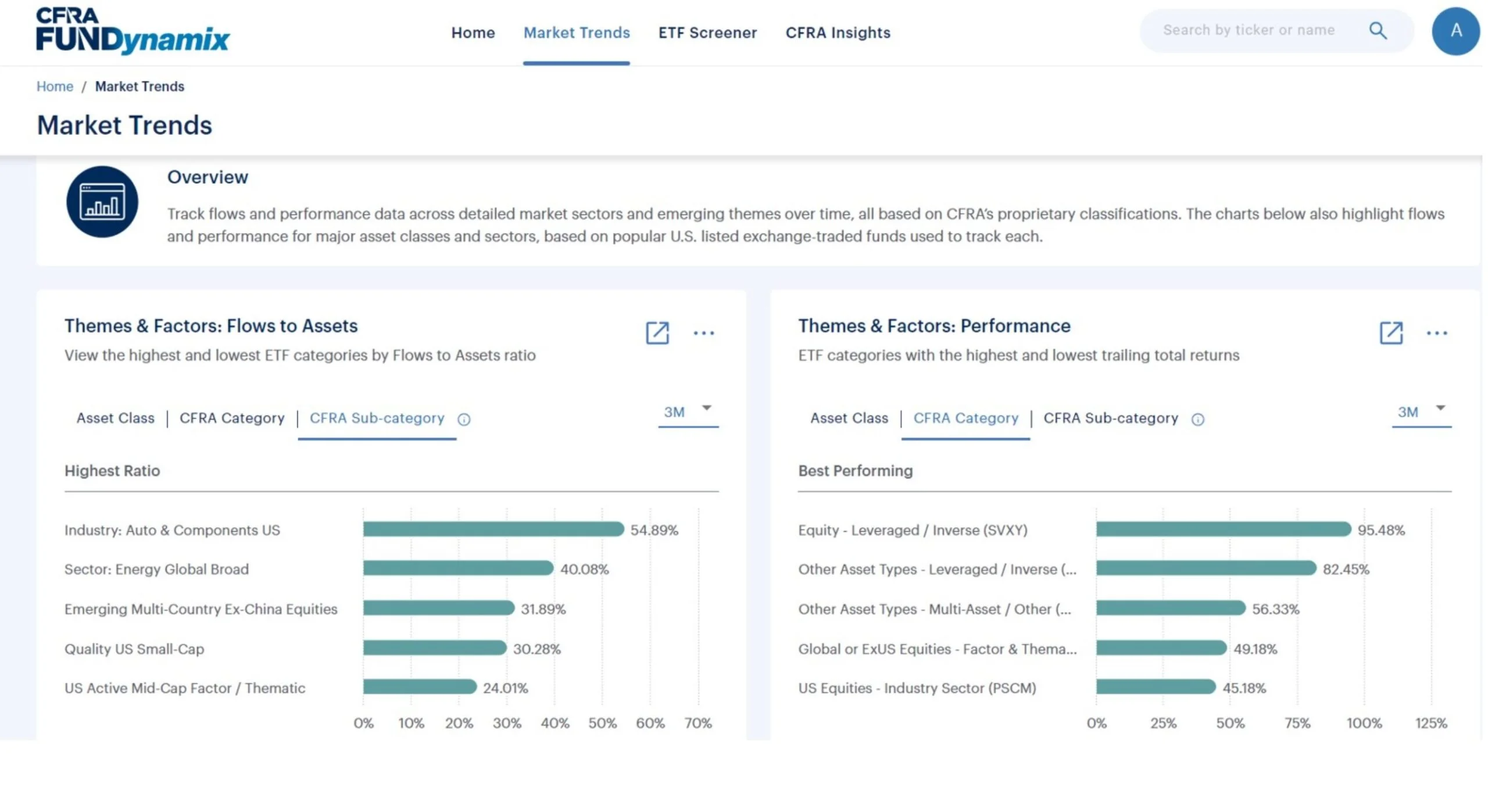

Stay ahead of trends

- Monitor ETF flows by asset class or theme to see where money is moving to (and from).

- Quickly identify the most popular and best performing themes, categories, and individual ETFs.

Identify Risk & Quality

- Examine each ETF’s holdings to uncover risks like concentration, credit, or use of derivative strategies.

- Analyze flows and performance at the product level to better understand risk.

- Integrated CFRA STARs Ratings and Scores (Cost, Reward, and Risk) to quickly assess the quality of each ETF.

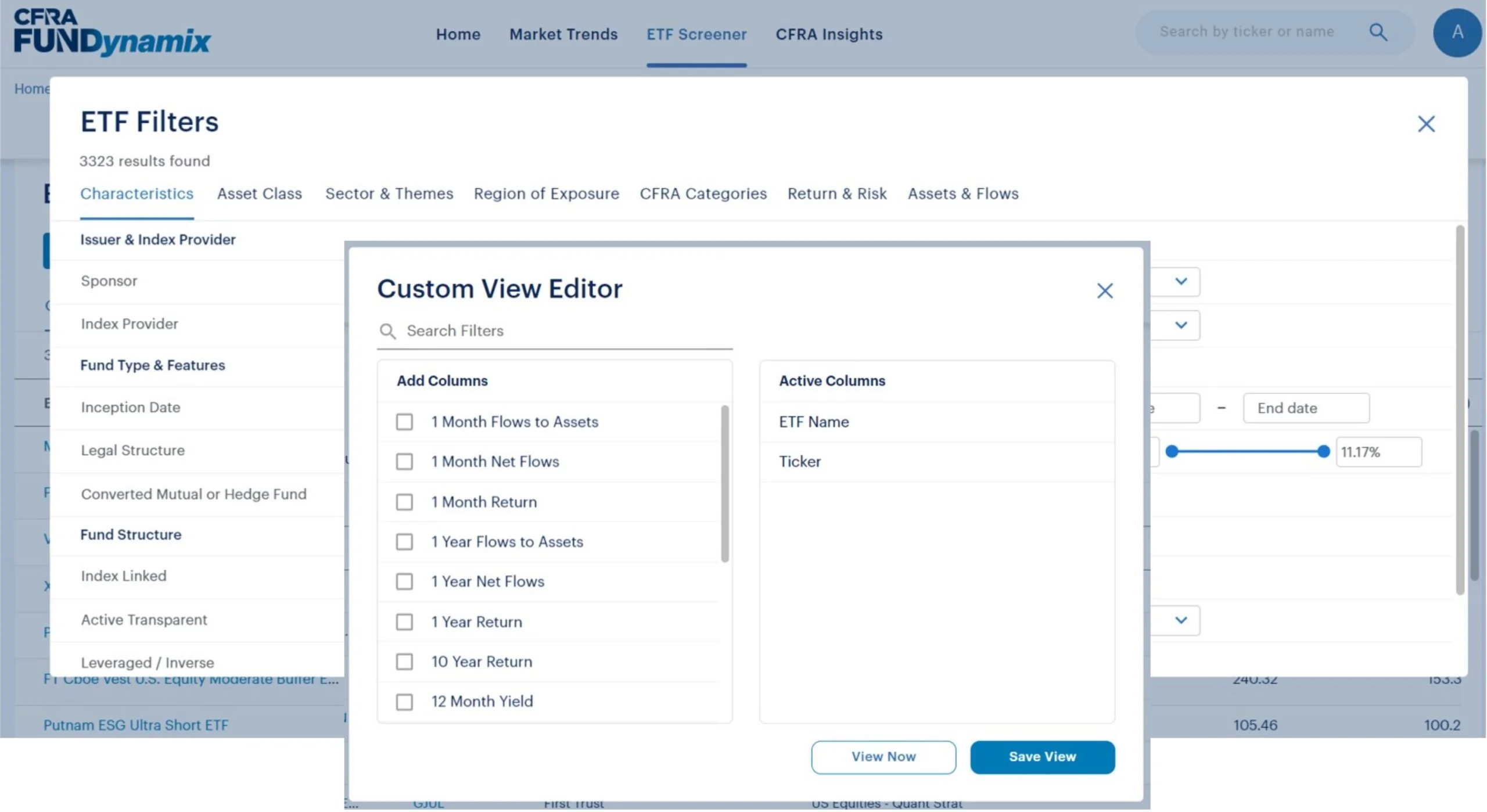

Curated and custom screens & watchlists

- Pre-made screens from CFRA based on trending themes and categories of interest.

- Screen and compare the ETF universe with nearly 100 granular themes and factors and create user-defined watchlists .

Stay on top of ETF trends and analysis

Monitor ETF trends

Identify granular ETF categories experiencing inflows or outflows, pinpoint the best and worst performing categories by returns, and track performance of key asset classes and sectors.

Screen & analyze ETFs

Create your own custom screens and watchlists to monitor a custom basket of peer ETFs or leverage one of the CFRA curated lists based on trending themes and categories based on the current environment.

An ETF data platform designed for ETF professionals

Real-time insight and specialized ETF monitoring and analysis

Wealth Management Users

- Platform Managers

Teams responsible for advisor and retail investor investment platforms.

- Research Teams

Teams responsible for broad market views, product due diligence, solicitation lists, and investment product creation.

- Financial Advisors

Construct portfolios, make investment recommendations, manage risk and suitability.

- Compliance & Due Diligence

Compliance teams who evaluate and monitor ETFs based on their risk, characteristics, or holdings.

Institutional Users

- ETF issuers

Product, marketing, and distribution teams at firms that develop, launch, and market funds.

- Investment teams

Portfolio managers, traders, and research professionals who evaluate, trade, and monitor ETFs.

- ETF service providers

Custodians index providers, and research firms that support the ETF ecosystem.

- Risk and compliance

Risk professionals who need to evaluate and monitor ETFs based on their characteristics or holdings.

Powered by CFRA’s ETF Database

Gain real-time insight into the global ETF universe by quickly analyzing trends, flows, and holdings data to identify new product and investment opportunities.

ETF Classifications

Simply the most comprehensive ETF classification framework in the industry. Our proprietary framework allows you to quickly search and identify ETFs across nearly 100 unique factors and themes.

ETF Constituent Holdings

Improve your risk management and avoid portfolio blow-ups by analyzing current and historical holdings and weightings data across the global universe of ETFs.

Statistics & Analytics

Stay on top of daily returns, monitor fund flows and trading volume for every ETF globally so you can stay ahead of your competitors.

Begin your free, 2-week no obligation trial to access the latest insights:

|

|